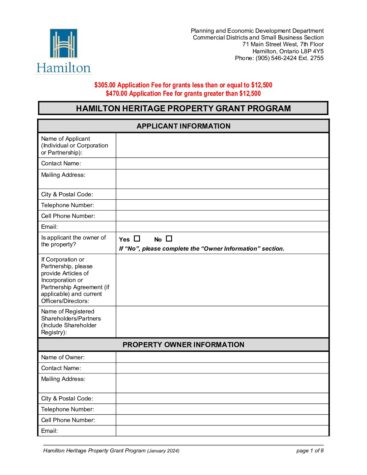

HAMILTON HERITAGE PROPERTY GRANT (HHPG) PROGRAM

| Overview: This Program is intended to provide financial assistance in in the form of a grant for structural / stability work required to conserve and restore heritage features of properties used for commercial, institutional, industrial or multi-residential purposes; the conservation and restoration of heritage features of properties; and for heritage studies/reports/assessments for properties that are designated under Parts IV or V of the Ontario Heritage Act. Amount: Grants will be based on municipal addresses, identifying multiple and separate units with ground floor street frontages and entranceways and will be up to a maximum of $150,000 plus up to an additional $20,000 for heritage reports / studies / assessments per municipal address for eligible work. Where: Eligible properties must be located within: The following Revitalizing Hamilton’s Commercial Districts Community Improvement Project Areas: Ancaster, Barton Village, Binbrook, Concession Street, Downtown Hamilton, Dundas, Locke Street, Ottawa Street, Stoney Creek, Waterdown and Westdale Commercial Districts; All Strategic Commercial Corridors; and the Mount Hope/Airport Gateway; or The lower city between Highway 403 and the Red Hill Valley Parkway and be designated under Parts IV or V of the Ontario Heritage Act. To identify your property’s heritage status, please click this link. Goals: conservation, restoration |